Here are the key updates from the Union Budget 2025 presented by Finance Minister Nirmala Sitharaman on February 1, 2025:

11:00 AM: Finance Minister Nirmala Sitharaman begins her Budget 2025 speech in the Lok Sabha.

11:15 AM: Announcement of significant tax reforms aimed at enhancing the spending power of the middle class and encouraging private investment to support economic growth.

11:30 AM: Introduction of initiatives focusing on inclusive development, targeting assistance for the poor, youth, farmers, and women.

11:45 AM: Finance Minister emphasizes the need for long-awaited land and labor reforms to drive medium-term growth.

12:00 PM: Unveiling of a mission to boost farm productivity with a focus on high-yield crops and raising the limit for subsidized credit for farmers.

12:15 PM: Stock markets respond positively; the Nifty 50 rises by 0.4% to 23,600.66 points, and the BSE Sensex gains 0.39% to 77,812.07.

12:30 PM: Fertilizer stocks climb following announcements of increased urea supply, while fisheries-linked stocks see significant gains due to a focus on sustainable harnessing of fisheries.

12:45 PM: Enhancement of credit guarantees for micro, small, and medium enterprises (MSMEs) to bolster employment.

1:00 PM: Some opposition members, including those from the Samajwadi Party, walk out of the Lok Sabha during the Budget presentation.

1:15 PM: Finance Minister announces the introduction of a new Income Tax Bill to be presented next week, with potential tweaks in income tax slabs for salaried taxpayers.

1:30 PM: The Budget session is scheduled to continue until February 13, with a recess before resuming on March 10 and concluding on April 4.

These updates highlight the government’s focus on stimulating economic growth, supporting various sectors, and implementing reforms to benefit diverse segments of the population.

Here are the key highlights from India’s Union Budget 2025, presented by Finance Minister Nirmala Sitharaman on February 1, 2025:

Economic Growth and Fiscal Deficit

- Projected Growth: The Indian economy is expected to grow at 6.3-6.8% in the upcoming fiscal year.

- Fiscal Deficit: The fiscal deficit for FY26 is pegged at 4.4%.

Taxation and Middle-Class Relief

- Income Tax Reforms: A new Income Tax Bill will be introduced next week, aiming to adjust income tax slabs to provide relief to salaried taxpayers.

Agriculture and Rural Development

- PM Dhandhanya Krishi Yojana: This new scheme will cover 1.7 crore farmers, focusing on enhancing agricultural productivity and farmers’ income.

- Fisheries Sector: Initiatives to sustainably harness fisheries have been announced, benefiting related industries.

Manufacturing and Infrastructure

- National Manufacturing Mission: A mission to support the “Make in India” initiative has been established, aiming to boost domestic production and export capabilities.

- Railway Sector: The Gross Budgetary Support for the Ministry of Railways is anticipated to increase by 15–18%, reaching ₹2.9 lakh crore – ₹3 lakh crore, focusing on high-speed rail projects, electrification, modernization, and green initiatives.

Social Welfare and Education

- Sashakt Anganwadi and Poshan 2.0 Programs: These programs will provide nutritional support to over 8 crore children, pregnant women, lactating mothers, and around 20 lakh adolescent girls in aspirational districts and the Northeast region.

- Atal Tinkering Labs: To encourage innovation among students, 50,000 labs will be established in government schools over the next five years.

Energy and Environment

- Nuclear Energy Mission: A mission to drive India’s transition towards clean energy has been announced, with a goal of developing at least 100 GW of nuclear power by 2047.

Financial Sector Reforms

- Insurance Sector: The Foreign Direct Investment (FDI) limit in the insurance sector has been raised to 100%, aiming to attract more international players and enhance competition.

Market Reactions

- Stock Market: Indian equity markets experienced marginal increases following the budget announcements, with sectors like fertilizers, fisheries, and banking showing notable gains.

These measures reflect the government’s commitment to accelerating growth, uplifting the middle class, and fostering inclusive development across various sectors.

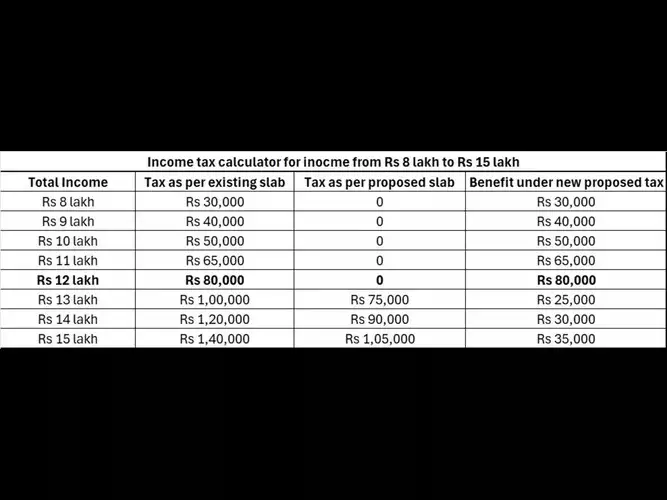

Income Tax Budget 2025 Live Updates: Income Tax Calculator: If you are earning below Rs 15,00,000, you will get the maximum benefit of the new, proposed tax regime in THIS tax slab

Income Tax Budget 2025 Live Updates: If your annual income is below the Rs 15,00,000 threshold, you can save a maximum of Rs 80,000 under the new proposed tax regime. Under the existing tax slabs of the new regime, you’d be liable to pay a tax of up to Rs 80,000. However, with the new proposed tax slabs, income up to Rs 12,00,000 is tax-free. For salaried individuals, this limit stands at Rs 12,75,000 (including Rs 75,000 of standard deduction already present in the new regime).

This means that those earning up to Rs 12,00,000 will have 0 tax liability under the proposed regime. After this slab, those earning Rs 11,00,000 would be able to save Rs 65,000 under the proposed tax regime, since their tax liability under the new, proposed regime would be Rs 0.